Drawing on the principles adopted by overseas DAF charities in determining qualified grantees and Chinese localized practice, the Charity will recognize legally existing non-profit organizations as qualified grantees in accordance with relevant rules and regulations.

(1)Relationship Between the Charity and Qualified Grantees

a) Contribution Relationship

When a qualified grantee serves as the grantee of the Charity, both parties will sign the Grant Agreement and build up a Contribution Relationship. The Charity, as the contributor, shall enjoy rights and fulfill obligations thereof.

b) Strategic Fundraising Relationship

Qualified grantees may establish a Strategic Fundraising Relationship with the Charity as qualified donors of the Charity. Qualified grantees may become qualified donors of the Charity by completing the Charity’s procedures and then open several charitable accounts. Based on the advantages of the DAF Account Service System as a platform, qualified grantees may educate and guide their specific potential strategic donors to open charitable accounts in the Charity and then encourage them to contribute either to specific charitable projects when the operation of these charitable projects come to a mature stage, or, as third-party donors, directly to charitable accounts opened by qualified grantees in the Charity. Therefore, charitable accounts opened by qualified grantees will become their strategic fundraising departments and assist in the transparent and dynamic management of their specific potential strategic donors.

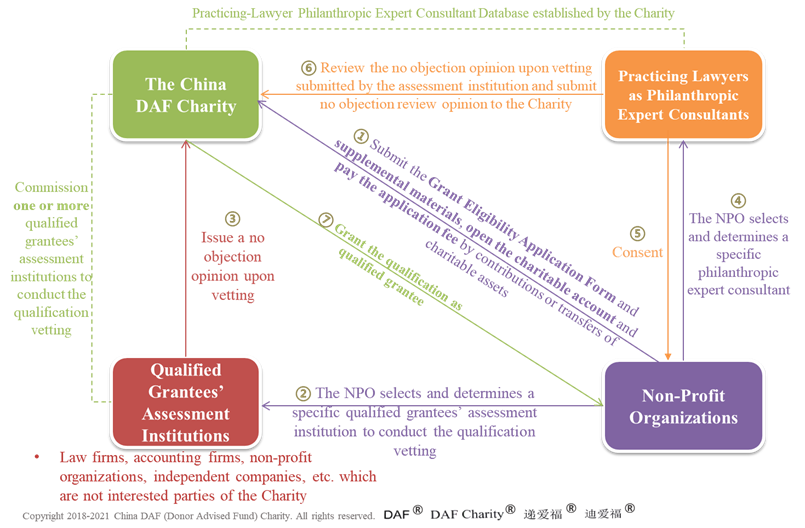

(2)Qualification Vetting and Review of the Charity’s Grantees

The basic application procedures for qualified grantees of the Charity are as follows:

(3)Application Fee and Deduction Methods

Considering the strategic fundraising business relationship between the Charity and qualified grantees, the Charity requiring an application fee is an important measure to encourage qualified grantees to conduct specific strategic fundraising based on the DAF Account Service System. Therefore, a non-profit organization’s application to be a qualified grantee of the Charity for the first time is deemed to authorize the Charity to deduct the application fee from its own charitable account in a lump sum according to the Management Measures on Fees and Expenses of the China DAF Charity. The deduction of the application fee from the non-profit organization’s charitable account is a prerequisite for starting the process of qualification vetting. If the deduction has not been completed, the Charity will refuse to start the qualification vetting. Specific standards for the application fee, paying methods and fee-deducting methods are elaborated on in the Management Measures on Fees and Expenses of the China DAF Charity.

(4)Dispute Settlement Mechanism of Disputes Between the Charity and Qualified Grantees

a) Parties to Communicate with the Charity During Disputes

When there is a dispute between the Charity and a qualified grantee, in principle, the charitable account advisor who has advised on a grant to this qualified grantee shall be the party to communicate with the Charity. If the charitable account holder raises an objection or the Charity deems it necessary, the charitable account holder shall be the party to communicate with the Charity.

b) Professionals Assisting in Dispute Settlement

In order to settle relevant disputes between the Charity and qualified grantees in a professional and convenient manner and to reduce the cost of poor communication, the charitable account supervisor may assist the charitable account holder or advisor in communicating with the Charity, while the philanthropic expert consultant may assist the Charity in communication and dispute settlement.

① Charitable Account Supervisors Assist Charitable Account Holders or Advisors in Communicating: A charitable account holder may select one charitable account supervisor from the 1-3 charitable account supervisors (if any) that they have nominated to assist the charitable account holder or advisor in communicating with the relevant parties. The charitable account supervisor shall do so within the scope of their power and function determined by the Charity.

If there are several charitable accounts granting to one qualified grantee, the charitable account supervisors thereof shall select one supervisor through consultation. If consent cannot be reached through consultation, the charitable account supervisor of the charitable account that grants the highest amount shall be the one to assist all the charitable account holders or advisors in communicating with the relevant parties.

② Philanthropic Expert Consultant Assists the Charity in Communicating: The Charity shall select one philanthropic expert consultant from the corresponding database to assist the Charity in communicating with the qualified grantees and relevant parties. The philanthropic expert consultant shall do so within the scope of their power and function determined by the Charity.

The specific process of applying to be a qualified grantee of the Charity and the procedure and criteria of qualification vetting are elaborated on in the Contribution Prospectus of the China DAF Charity and the Contribution, Investment, and Granting Guidelines of the China DAF Charity.

Click Here to Download:

Contribution Prospectus of the China DAF Charity

Contribution Prospectus of the China DAF Charity

Contribution, Investment, and Granting Guidelines of the China DAF Charity

Contribution, Investment, and Granting Guidelines of the China DAF Charity

Click Here to Enter: